Onboarding Methods

Migrate from Excel

To initiate, sign up for an account at angellist.com/equity. Navigate to Company Settings, then click Billing to pay for a pricing plan. Note that payment is a prerequisite to AngelList’s onboarding team getting started.

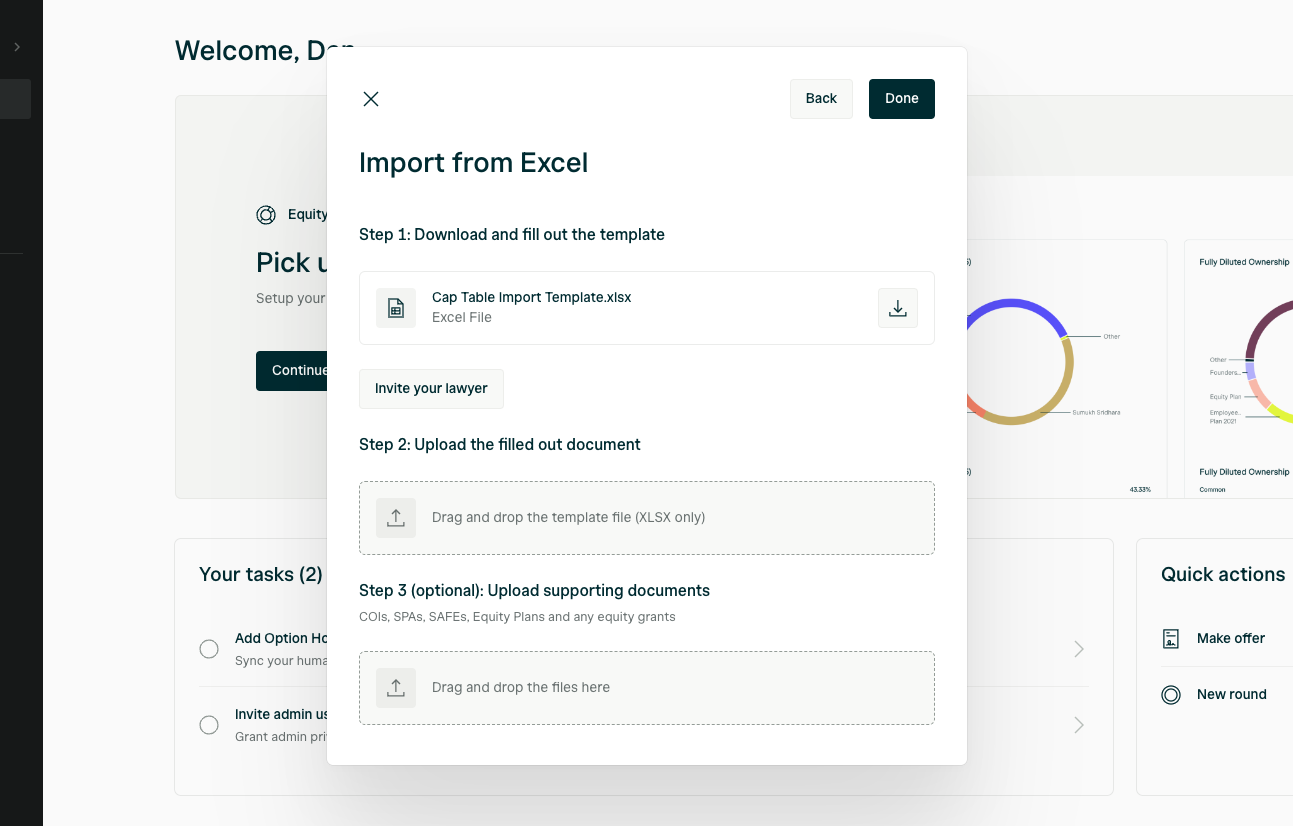

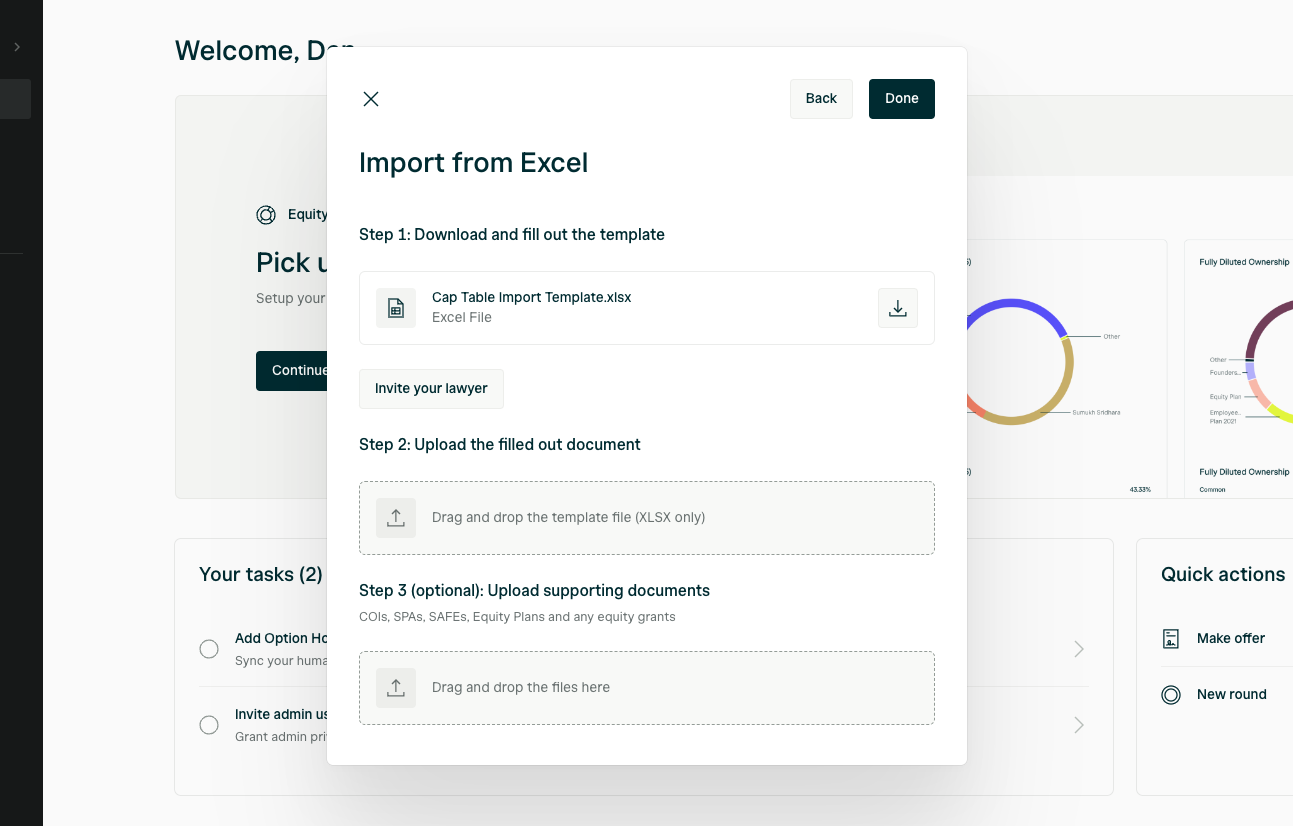

Then, in the Equity app, click “get started” with setting up your cap table. Choose “Move your cap table” then Excel. You’ll see this screen:

Once you have entered your payment information, you’ll be asked to upload all necessary files and documents. From there, our team will get started on setting up your cap table in AngelList Equity.

For more detail on what information you will need to provide, see below.

Once you have entered your payment information, you’ll be asked to upload all necessary files and documents. From there, our team will get started on setting up your cap table in AngelList Equity.

For more detail on what information you will need to provide, see below.

Contact us

If you run into issues or have questions, our team is available on business days with a 24-hour turnaround time. For any questions not answered in this guide, feel free to suggest a question.✉️ E-Mail: startups@angellist.com for your questions.

What happens after I submit files and documents?

You will receive an email from the AngelList Equity onboarding team when they begin the process of building your cap table in AngelList Equity. We will configure your cap table, equity plans, and add any active securities. We’ll invite you to review and approve the cap table once all provided information has been input. If applicable, we can also invite your attorney for review. Once your cap table has been completed and approved, you’re ready to invite stakeholders to their portals and manage your cap table on AngelList Equity.How long does the onboarding process take?

This depends on the complexity of your cap table. Once AngelList has all documents needed, a company with around 25 employees/shareholders without a priced round will take around one business day. A company with around 50 employees and one or more priced rounds can take up to three business days.Why do we need to provide historical information about the company?

Historical information allows AngelList to reflect major historical changes such as conversions of notes in priced rounds, share repurchases, and employee stock option exercises/terminations. This historical record will assist you with investor relations, tax preparation, compliance, and any audits.Any tips for an extra-smooth process?

Invite your team early on.

- Invite your lawyer if they’ll be involved in the approval/management of your cap table.

- Invite all users and set up their permissions.

- Let your employees and shareholders know that you’re moving to AngelList. We can provide you with an email template to help.

Let us know when you hit roadblocks.

If your prior cap table software provider is making it hard for you to migrate to AngelList, let us know by emailing startups@angellist.com. We’re always happy to help out.Onboarding Documents

Once you’ve created your AngelList account and logged in, upload all the documents below to Legal > Documents.What information do I need to upload?

At a high level, we’ll need equity documents, valuations, shareholder contact information, and additional information.Required Equity Documents

- Original and (if applicable) amended Certificate(s) of Incorporation

- Founder Stock Purchase Agreements

Other Equity Documents

- Cap table/stock ledger export: We use this to build a comprehensive and accurate view of your company since its inception

- Share both a summary by share class and a detailed version by shareholder in an excel or Google Drive sheet

- All historical securities transactions, including any canceled/repurchased securities

- Historical 409A valuations: we’ll add the value of each security if you provide us with the documents for any previous valuations

- Historical board-approved Fair Market Values (if not included in the valuation report)

- Any non-founder Stock Purchase Agreements

Stakeholder Contact Info

Let us know who is on your team by uploading an excel sheet. For anyone with equity (employees, advisors, investors), we require their full name (for individuals) or entity name (if a company), title, and work and personal emails. Personal email helps AngelList manage your stakeholders if they are ever terminated and hold equity in your company. Note: No emails are sent to your stakeholders during the onboarding process. You have the option of sending emails to them after onboarding is complete, but it is not required. Inviting them allows your shareholders to see their holdings in a personal dashboard.Additional information

These documents are optional, but help us make sure we have complete information when setting up your cap table and issuing securities. If your company has any of the following, please send them to us in PDF format:- Board-approved stock option plan document

- Option agreement and exercise forms

- Option pool history with board approval dates and total option pool shares

- List of unexercised warrants

- List of unconverted convertible notes and SAFEs

- Option agreement form or template

- Exercise notice form or template

- Warrant form or template

- Convertible note form or template

- Termination dates from HR or payroll system

- Board approval documents for fundraises

- Equity Plan documents

- Board approval for the Equity Plan

- Form of Board Consent for Stock/Option Issuance

- Form of option agreement (also known as a “template”)

- Form of exercise notice (also known as a ”template”)

- Individual grants and vesting schedules

- Board approval documents for each grant

- Warrants Form of warrants (also known as a ”template”)