Note: Option exercise transactions are only available to companies on the Growth, Growth Plus, and Scale plans.

Enabling Option Exercise in AngelList Equity

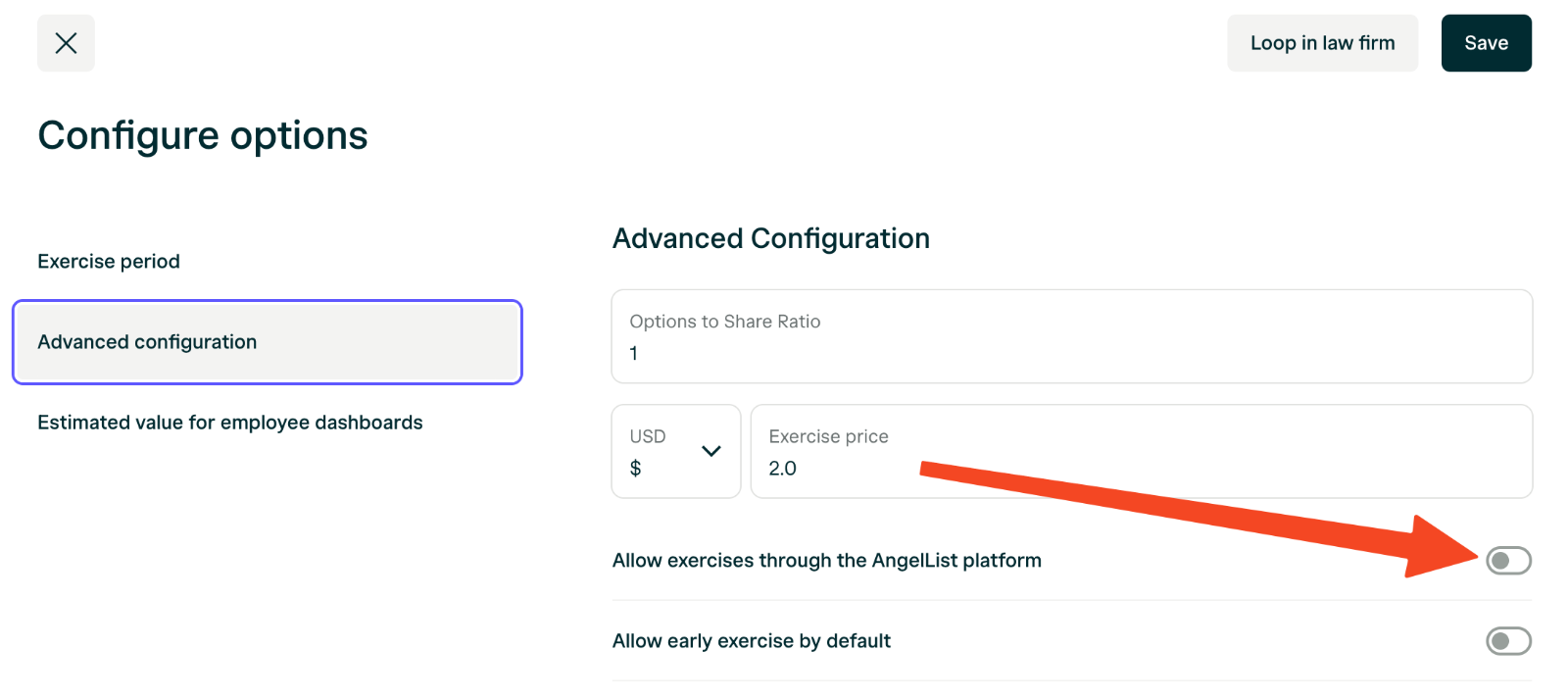

To enable option exercises through the app, navigate to Equity > Equity Plans and select the plan you’d like to enable option exercises for. Navigate to the Options tab and click Configure. Toggle on Allow exercises through the AngelList platform and Save.

If you haven’t link a bank account for online exercise payments, follow the instructions below.

If you didn’t configure the option exercise agreement when you set up your option grant template, you’ll also need to update the grant template to include a configured exercise agreement here.

Link a bank account to receive exercise payments

- Navigate to your equity plan and click Actions > Managed linked bank accounts.

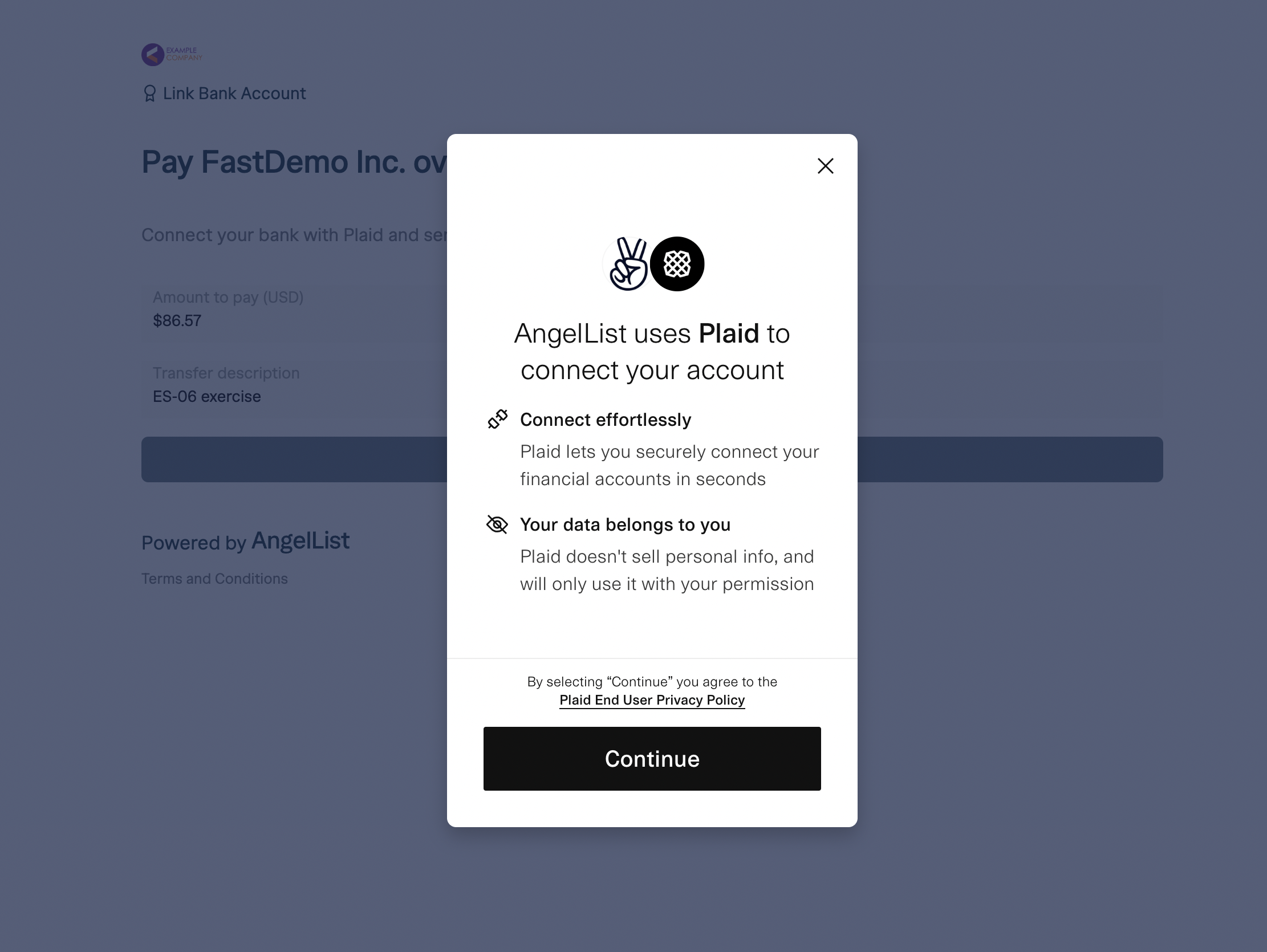

- Click Link an account to link a bank account via Plaid:

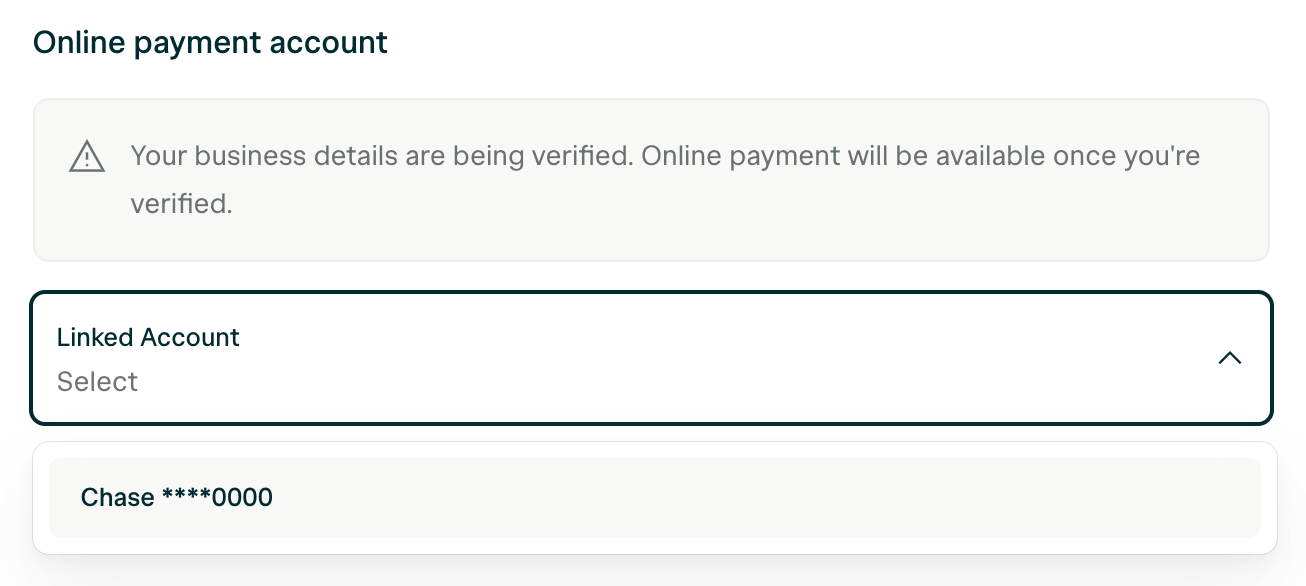

- If this is your first time linking a bank account, you will be asked to provide information about your business. This is used for security purposes in order to verify the account. This step is only required the first time you link an account.

Your business details will typically be verified in less than one business day.

- Next, link you will be prompted to link an account.

- Finally, select your account from the dropdown. Once your business verification is processed, your stakeholders will see the option to pay for exercises online.

How do option holders exercise their options?

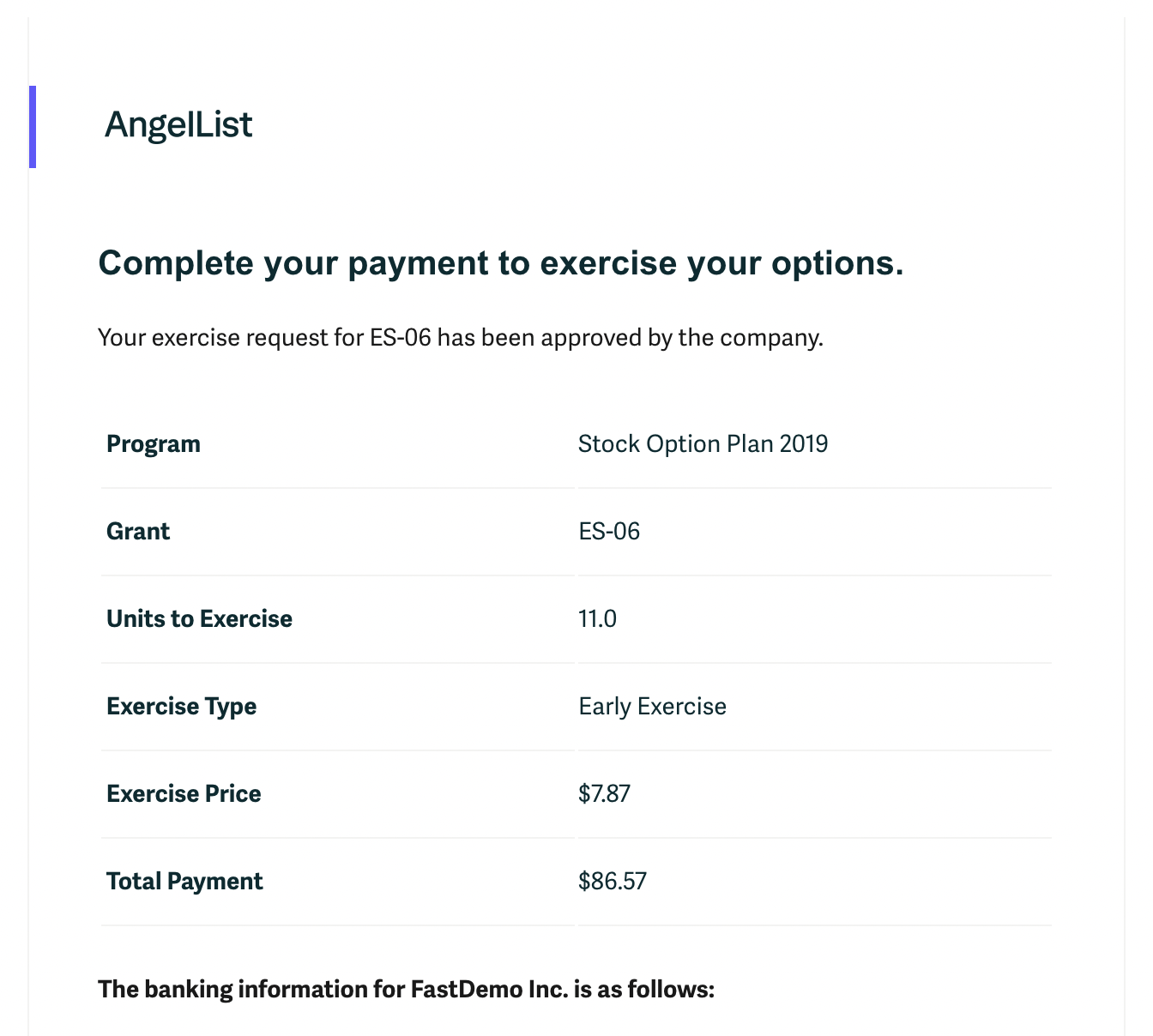

If in-app exercises are enabled, option holders can click Exercise Options on their dashboards to select an option grant to exercise. This takes them to a page where they can specify the number of options to exercise, verify their personal information, and view exercise costs and estimated taxes. Upon submission, they’re directed to a confirmation page.

Click here to view the process from the stakeholder’s perspective

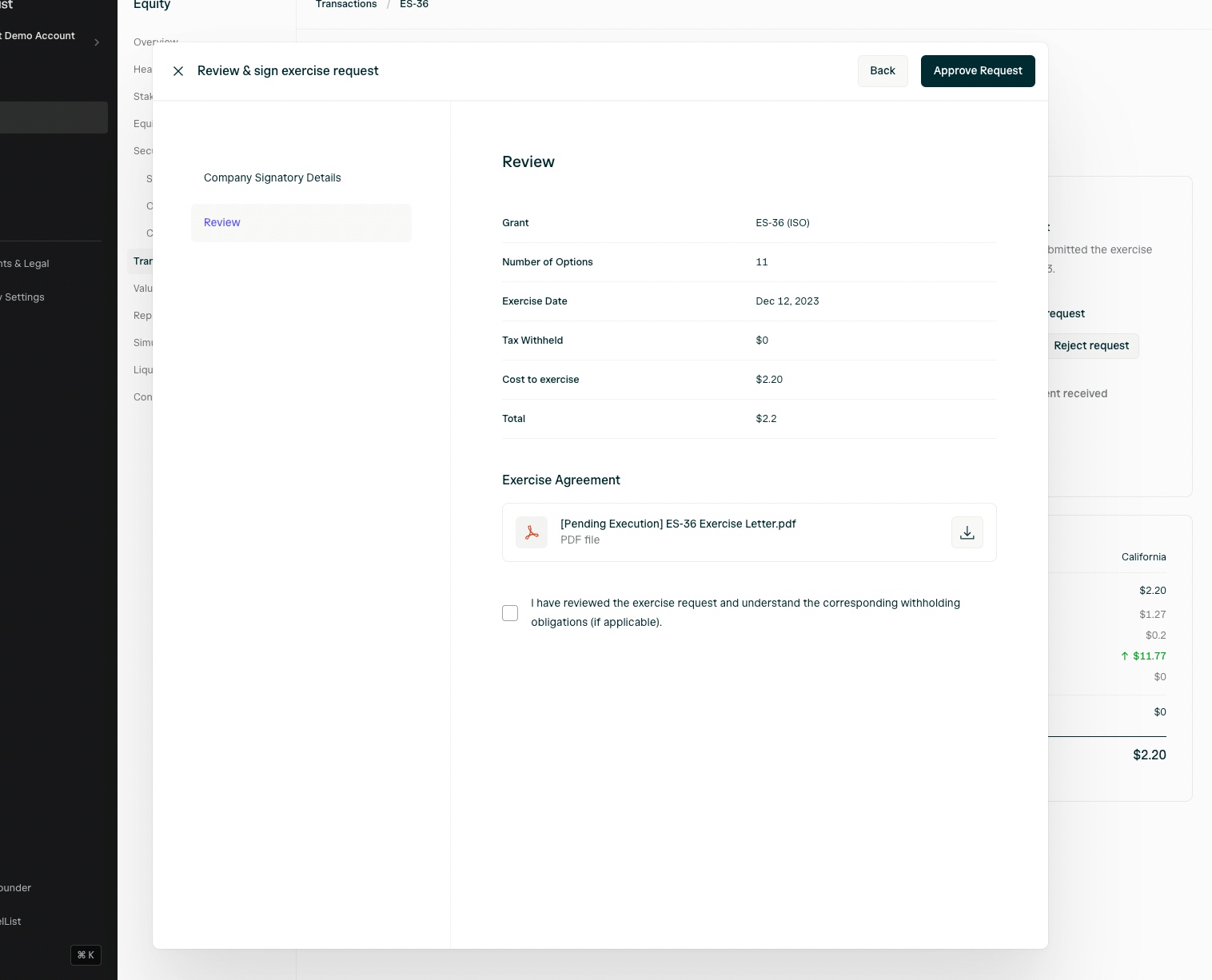

Company admins then receive a notification to review the exercise request, including withholding tax amounts, the option holder address, the status of the option (ISO/NSO), along with the exercise agreements.

Note: It’s important to consider tax withholding requirements with the help of your legal or accounting teams prior to approving an exercise request.

After the Company receives exercise payment

Company admins are able to record the payment date in the cap table and issue the resulting shares to the exercising stakeholder.

You may connect a third-party bank account in Company Settings > Banking Information:

After adding a bank account, navigate to your Equity Plan, edit it, and select the bank account from the drop down menu. If it doesn’t appear, then refresh the page and try again:

How do I record a historical exercise that has already been executed?

Navigate to the option page for the exercised option from Securities > Options.

From the option page, navigate to the Transactions tab and select “Add existing exercise”.

Complete the form with the relevant details.

Note: Manually recording an exercise does not automatically generate a resulting share entry/certificate. If you also need to issue shares, then you need to separately follow the share issuance steps here. Where can I view historical exercises?

Transactions (option exercises, share repurchases, share transfers, and conversions) appear in the Transactions tab:

You may also view the details of an exercise, create and store 83(b)s, and generate and share Forms 3921 from the exercise detail page:

You may also download various reports that contain exercise-related information from the Reports tab:

Company admins can either generate or upload and share a Form 3921 with option holders who have exercised their options during a tax year.

To generate Form 3921 and share it with option holders, navigate to the Transactions tab, visit the individual exercise’s detail page, and scroll to the bottom of the page to find the Form 3921 section of the Exercise transaction page:

Sharing Form 3921 with option holder will make the form available on the option holder’s stakeholder dashboard:

Employee’s dashboard with Form 3921:

Form 3921 can be submitted either electronically (due by April 1) or through mail (due by February 28). Three distinct copies of the form are necessary:

-

Copy A should be submitted to the IRS, either online or via mail.

-

Copy B must be provided to the option holder who exercised options by January 31.

-

Copy C should be retained for your company’s records.

From the year 2024 onwards, if you need to submit 10 or more Form 3921s or other similar returns, you are required to file them electronically by April 1, for the tax year. To prepare for filing, you should gather:

-

A roster of option holders who exercised incentive stock options in the last year.

-

Their tax ID numbers, complete names, and addresses.

-

Your company’s transmitter control code (TCC).

-

For online filing, access to the IRS’ FIRE (Filing Information Returns Electronically) system is needed.

For Online Filing:

If this is your first time filing online, you must file Form 4419 electronically to obtain a TCC from the IRS, which is necessary to create a FIRE account. This process could take several weeks, so it’s advisable to begin at least a month before the deadline (by March 1, 2024).

For Filing by Mail:

If filing by mail, remember that forms printed at home are not acceptable. The IRS uses specialized machines that only read forms printed on IRS-provided paper. This paper can be ordered from the IRS website.