The SAFE Cleanup offering has been replaced by Consolidation Vehicles:

We have replaced SAFE Cleanups with a new product, that does move investors into a single line retroactivelyTo learn more about this, please consult Rollups.comFor Startups

This guide will help you launch your SAFE Cleanup. It covers:

- How to use SAFE Cleanups in AngelList

- How to inform your legal counsel

- How to inform your SAFE holders

Are SAFE Cleanups different from Roll Up Vehicles (RUVs)?

Yes. RUVs streamline future fundraises. SAFE Cleanups streamline previously signed SAFEs. If you’re looking for RUVs, click here.- Neither change the financial terms of the existing underlying agreement.

- SAFE Cleanups work for existing SAFEs.

- RUVs work for new SAFEs, equity rounds, and convertible notes.

- Both are available for a one-time fee or as part of AngelList Growth plan.

How do I use SAFE Cleanups in AngelList?

Using SAFE Cleanups is easy. If you’re not already on AngelList, you’ll need to sign up. Complete these steps:- Navigate to Equity > Stakeholders, and add your SAFE holders and their email addresses.

- Navigate to Equity > Securities > Convertibles, then import all SAFEs that have already been signed. This prepares them for SAFE Cleanups.

- Once imported, click “Bulk Issue SAFE Cleanups” in the top right to initiate the SAFE Cleanup, and complete the steps.

Which pricing plan do I need?

SAFE Cleanups are available independently or as part of AngelList’s Growth plan. To upgrade from within your dashboard, navigate to Company > Billing.How do I invite investors?

Navigate to the SAFE that you would like to Cleanup. Within the SAFE, clickSend Rollup Agreement. We’ve included some suggested copy, but you’ll be able to customize the message for each investor.

What will investors be emailed?

First, investors will receive the custom invitation you send. After that, they’ll get an invitation to sign the SAFE Cleanups Agreement. This SAFE Cleanups Agreement email also contains a link to an investor specific FAQ.

Where can I see the executed SAFE Cleanups Agreement?

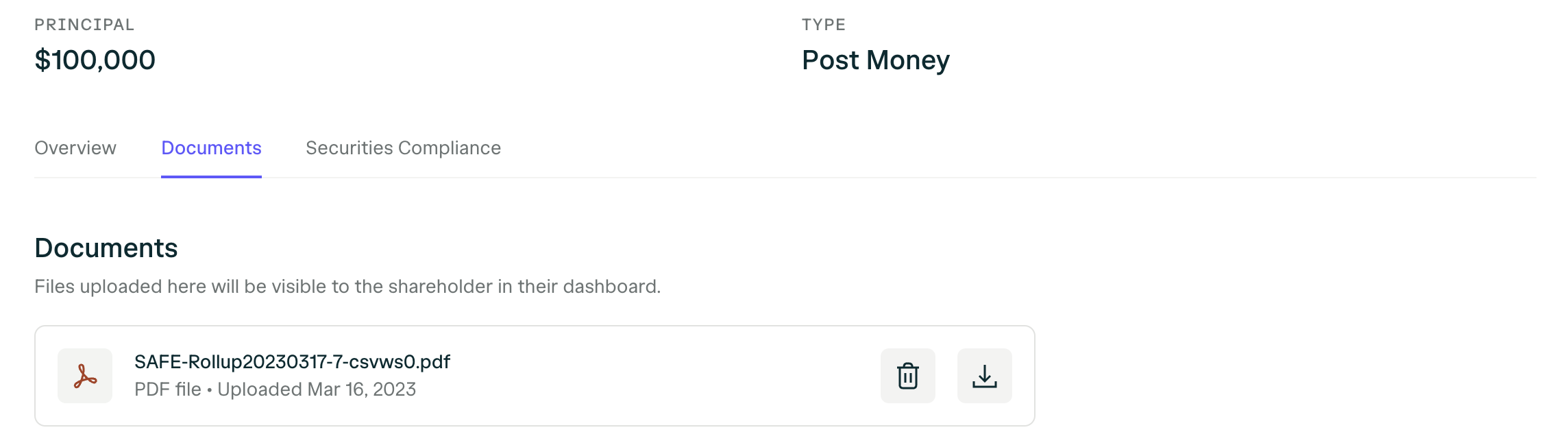

To view an individual, fully-executed SAFE Cleanup Agreement, navigate to the specific SAFE and select Documents.

Does my legal team need to be part of this?

It’s a good idea to loop in your company’s legal team on your decision to run a SAFE Cleanup. The SAFE Cleanup Agreement was carefully drafted by legal professionals and has been signed by leading venture funds. If your legal team has feedback on the terms or structure of the SAFE Cleanup Agreement, we’ll happily receive it for consideration in future versions. Our ability to offer the software infrastructure to support SAFE Cleanups economically means we need to keep the terms standardized. We can’t make one-off markups to the template agreements. Here is some messaging you can use your counsel:Hello,As you know, we have multiple SAFE investors. We wanted to give you a heads up that we will be using SAFE Cleanups to streamline future company transactions.SAFE Cleanups streamline how many signatures our team needs to collect when we close future transactions by granting a limited power of attorney and voting proxy to approve certain transactions on behalf of our SAFE investors and the shares issued upon SAFE conversion.We understand this approach is not the historical “norm,” but many great venture-backed companies are using it and leading venture funds are signing it. If you have questions, please see the FAQ for law firms. We are excited to innovate in ways that save everyone time and money.

What should I tell my SAFE holders?

AngelList automatically sends an email to your investors that explains SAFE Cleanups, but you may also want to email your existing SAFE holders more details ahead of time. Here is a template you can use:Hello,We’ve been using AngelList to manage our raise capital and get the most out of our equity. They have a new product, SAFE Cleanups, that will allow us to accommodate a distributed investor base and close future company transactions quickly and efficiently.You should receive an invitation to sign the SAFE Cleanup Agreement shortly that will contain more information. You can also review the Investor FAQ.The SAFE Cleanups Agreement does not change the economic terms of your investment. Instead, it streamlines how many signatures our team needs to collect when we close future transactions by granting a limited power of attorney and voting proxy to approve certain transactions on behalf of your SAFE and the shares issued upon its conversion.The document includes additional context, and we have cc’d AngelList who can answer any questions you might have.We hope to have signatures completed by [date].Thank you,[Founder]